LAW OFFICES OF JONATHAN P. MUSGROVE, APC

What can we help you with today?

Estate Planning — Wills and Trusts — Business and Contract Law — Personal Injury

Give Jon a call today at (858) 386-4080

Estate Planning Attorney in San Diego, CA

FAQ’s and Things To Know About Managing Your Estate

If you’re looking for an estate planning attorney, you probably have a lot of questions. You also want someone that’s looking out for your best interests. Jonathan Musgrove is a compassionate, educated attorney in the field of estate planning and business law that is dedicated to helping his clients.

With this website, we do our best to answer pertinent questions. We encourage you to fill out our brief form or call us to set up a free consultation. We are here to help in properly allocating your estate upon your departure how you want it handled.

Estate planning is the responsible way of planning for the distribution of your assets when you pass away or in the event of disability or incapacity during life. If you live in San Diego you must use a licensed California attorney to prepare your estate plan documents.

Not only does it put you in control and ensure your wishes are followed, it can also spare your loved ones of the expense, delay and frustration associated with managing your affairs when you pass away, become incapacitated, or disabled.

There are a lot of reasons you might prefer a trust in addition to a will.

- Save on attorney and court fees. There are minimum probate costs based on the value of the estate – learn more about this on our wills and trusts page.

- Avoid delays in the transfer of property to beneficiaries.

- Possible tax savings.

You can also choose your beneficiaries as if you were writing a will.

If you die, and your estate’s assets are not managed by a will, living trust or joint-arrangement, you’re leaving these decisions up to the State of California. The probate court chooses the personal representative.

This process is called ‘intestate succession’. And it’s not as uncommon as you may think; 55% of Americans die without a planned Will. This means you, as the decedent, relinquish all control. The probate court chooses your personal representative.

This means the wrong person may be selected to administer the estate – or be the guardian of their minor children. And this also means that beneficiaries may be people you didn’t want to receive your property.

These proceedings only apply to property that would have been transferred in probate as if there was a Will. There are no consequences to life insurance or retirement benefits.

In California, assets go to the closest surviving relatives of the decedent. This means children, your spouse, parents and siblings.

If you and your spouse are legally separated, your spouse will not be entitled to your property. This applies even if you are not yet divorced. If you want to learn more about this, we encourage you to fill out our form.

Simple missteps can have very dire consequences for your estate.

If your will is handwritten, it’s easily challenged.

While it may feel like the true testament of your wishes, handwritten Wills are often unclear and incomplete. They also lack ‘Testamentary’ language to be valid in a courtroom and are unlikely to have been properly witnessed.

Even if you have a professionally-prepared will, you can still invalidate it by mistake.

What many decedents don’t realize is making their own modifications to the Will can invalidate the entire document. Attempting to add language, or cross out terms, without following the appropriate procedure can leave the court without any testamentary document to reference.

You can use testamentary language on your will to pour assets into a trust. This is useful if property was overlooked during the estate planning process.

Some assets also require the probate process. This includes any assets with a title that are only in your name, or a share of property in a “tenancy in common” arrangement. This is not to be confused with “joint tenancy”.

And if your will includes a testamentary trust, these assets must also go through probate.

They’re easy to establish and can help you avoid probate court, but you may be putting your assets at risk. Remember that you’re effectively giving away half of your ownership of the property.

This can have consequences for you if they mismanage it or owe creditors. When transferring assets to the joint tenant, you may be expected to pay a federal gift tax. While this doesn’t apply to spouses, your partner can miss out on a big income tax break when the property sells.

Joint tenancy also means that the surviving partner gets the entire asset. This overrides any testamentary language in your Will. And before the last joint tenant passes, they need to find another avenue (like a Living Trust) to avoid probate.

This immediately creates a taxable event, so keep your beneficiary as intended. As a safety net, you can name your trust as a backup beneficiary.

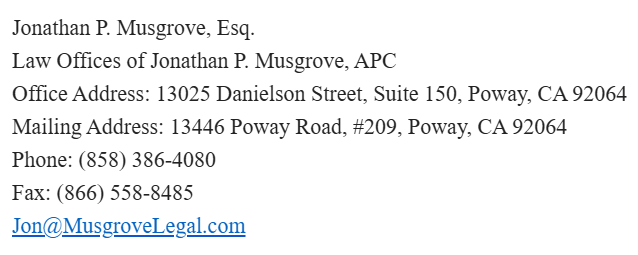

Contact Us

If you have questions or looking for guidance, give us a call or fill out the form. We will reach you shortly.

If you need estate planning in San Diego, an attorney that understands the nuances of California Probate Code will help ensure optimal management of your estate.

We’re always available for questions. If you fill out our form, we’re happy to answer any questions you have.